In the fast-growing world of PAYGO (Pay-As-You-Go) and BNPL (Buy Now, Pay Later) smartphone sales, distributors in Africa face significant challenges with non-adapted IT systems. Many phone retailers and microfinance companies still rely on legacy CRM (Customer Relationship Management) and LMS (Loan Management System) platforms that fail to meet today’s market demand.

Upya offers a specialized solution designed specifically for PAYGO and BNPL smartphone sales, providing a next-generation LMS and CRM platform built for emerging markets.

A Platform Built for Africa’s Unique PAYGO/BNPL Smartphone Sales.

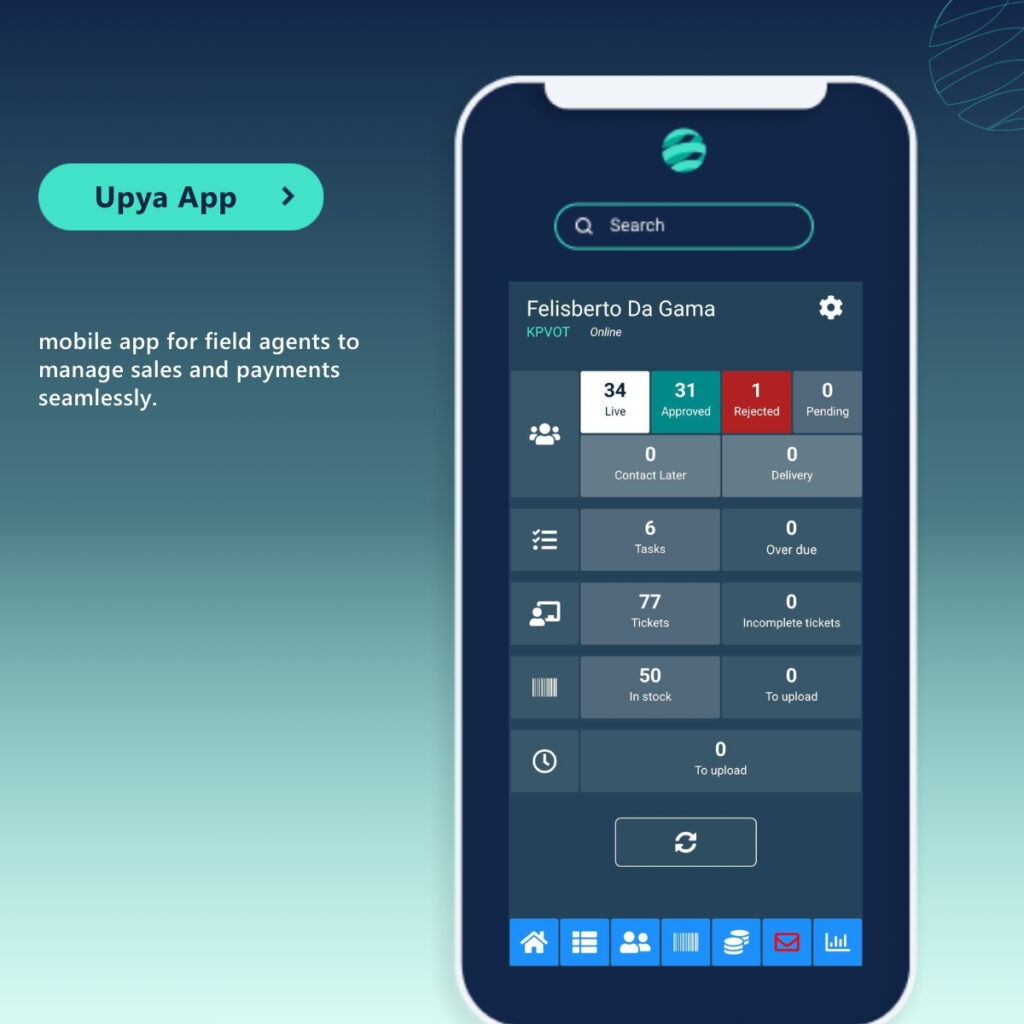

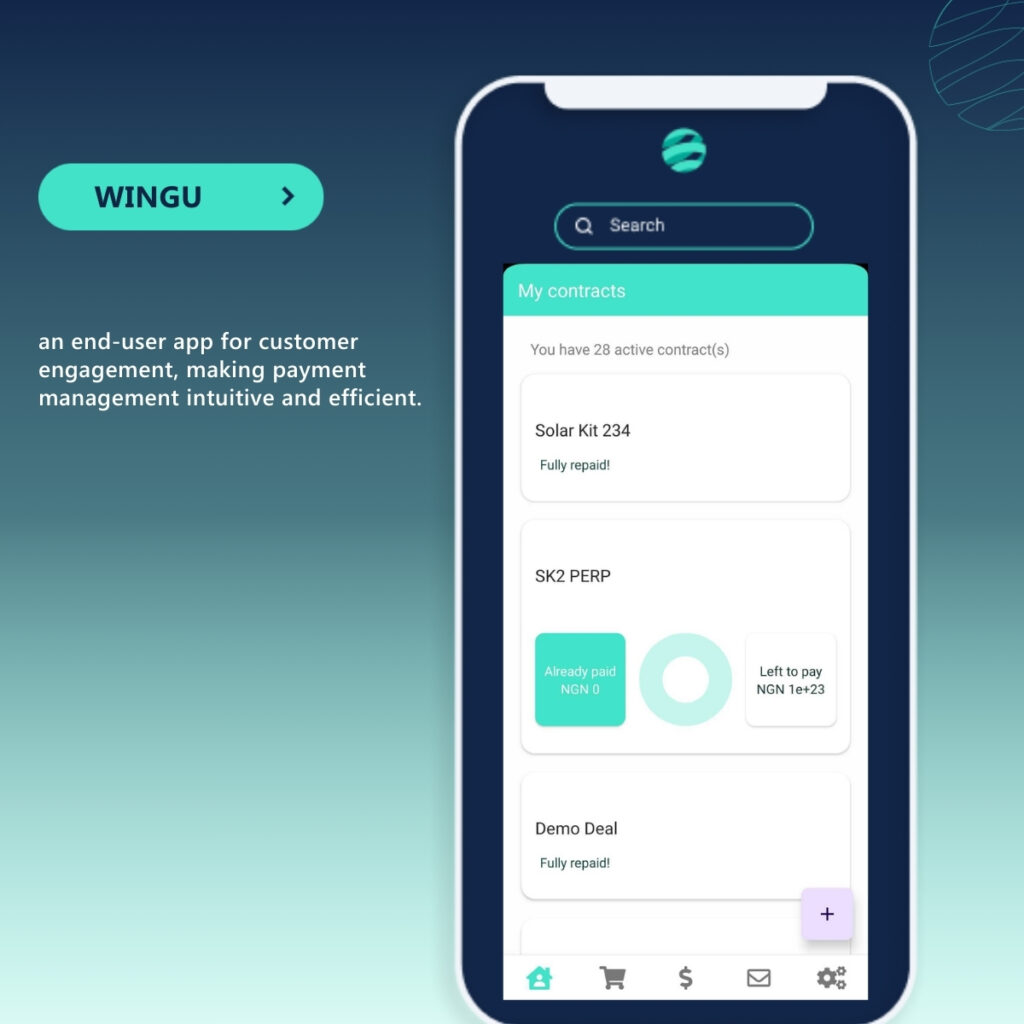

With over five years of experience in African markets and more than 100 customers, Upya delivers a web platform and mobile apps that streamline customer onboarding, automate payment management, and ensure efficient field operations. Our solution includes:

Seamless Integration for Growth

Thanks to Upya’s open APIs, businesses can effortlessly integrate the platform with their existing IT infrastructure. With 20+ mobile money integrations spanning 10+ African countries, the platform ensures secure tracking of customer payments. Additionally, 8+ bulk SMS provider integrations enable seamless communication at scale.

The Upya solution is directly integrated with key OEMs such as Samsung and Tecno (and other Transsion brands), and through its partnership and integration with the likes of Trustonic and Nuovopay allows its clients to manage 150+ Android models on Upya. These integrations allow smartphone lockability based on payment status, boosting sales by enabling instalment plans and maintaining control over repayment rates.

Power of automation

Automations are a specialty of Upya’s value proposition. Key automated processes include:

- KYC data collection: automated credit scoring and approval workflows to accelerate client validation

- Unit repossession & contract transfers: fully automated processes that increase revenue and streamline customer support field operations

- Payment reminders: automated reminders sent via bulk SMS or the Wingu app keep customers on track of transactions

- Field agents coordination: a task management system that ensures structured and controlled field teams operations

- Shop management: support for up to four levels of hierarchical replication (Countries > Regions > Partners > Shops), facilitating seamless scaling of operations

Proven Success in Smartphone Financing

Upya’s LMS achieves a 97% repayment rate, demonstrating reliability and effectiveness. Businesses gain:

- Enhanced customer data and payment control.

- Streamlined inventory management and field operations.

- The ability to scale operations while minimizing financial risk.

Upya’s tailored solution for PAYGO/BNPL smartphone sales empowers phone retailers and microfinance institutions to drive growth, boost sales, and deliver financial inclusion across Africa.

Learn more about about Upya´s Field Solutions for PayGo smartphones here.