Every two years, we gather with friends, colleagues, and industry peers at the GOGLA Conference to connect, celebrate, and collaborate on our shared mission to electrify the approximately 760 million people who still lack access to electricity.

In its tone, the challenges and opportunities highlighted, this year’s event was a clear extension of the meeting that took place in Amsterdam between Gogla members back in June; which we covered in our blog titled “Rural Electrification Looking for a Second Wind”.

The challenges and opportunities highlighted at this year’s Forum were a natural extension of those conversations. In this blog, we want to share our GOGLA Forum 2024 takeaways that underscore the evolving landscape of the off-grid solar sector.

Productive Use Equipment – A Growing Focus.

Walking through the Expo clearly showed how Productive Use Equipment (PUE) has become central to the off-grid ecosystem. Manufacturers of fridges, solar pumps, and mills were prominently featured, signaling that PUE is here to stay and play a lasting role in the industry.

At Upya, we see diverse customer approaches to PUE—from companies specializing in specific segments to distributors targeting small businesses with advanced SHS solutions.

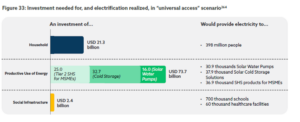

During a plenary session, experts shared that $74 billion is needed to tap into solar water pumps, cold storage, and MSME electrification markets, representing three times the investment required to electrify all households. Such growth potential promises transformative impact.

E-mobility players – Nice to see you

Last year, we saw hints of a connection between Off-grid Solar (OGS) and E-mobility, like BBOXX’s partnership with Ampersand. This year, more e-mobility players, including Ampersand, Roam, and Ewaka, Ebee and more showcased innovations. Investors are taking note, as evidenced by Spiro’s recent moves, signaling that the sector’s momentum is building.

As the industry matures, there are critical learnings to take from their PAYGO SHS counterparts:

- Asset Financing and Cash Flow Management: just like PAYGO SHS, e-mobility relies heavily on asset financing, cash flow management, and repayment rates.

- Vertical Integration Lessons: the PAYGO SHS sector initially pursued vertical integration at a high cost, only to later shift towards specialization in distribution and agent management. E-mobility players should take note of this trend.

We have explored these themes in greater detail in previous blogs, and it was encouraging to see the forum serve as a platform for sharing best practices between two sectors with so much in common.

The Usual suspect – Financing and Forex

GOGLA reports show investment in the OGS sector rose to $1.2 billion in 2022–2023 from $773 million in 2020–2021. However, access to finance remains a major hurdle for small and mid-sized distributors, limiting growth due to high ticket sizes. Fortunately, new initiatives aim to broaden financial access for these players, raising hopes that financing will no longer dominate discussions by 2026.

Additionally, forex volatiliy especially in countries like Nigeria and Malawi, adds another layer of complexity. Addressing forex fluctuations is crucial for sustainable growth across varied markets.

The 2024 Global Off-Grid Solar Forum served as a platform to explore productive use equipment, e-mobility, and financing challenges. The heightened focus on Productive Use Equipment underscores its key role in economic growth and widening electricity access for underserved communities. Furthermore, collaboration between solar and mobility sectors could drive innovative solutions, enhancing the off-grid landscape.

Looking Ahead

Despite considerable progress, financing barriers persist for smaller companies, and forex volatility remains a significant concern. Going forward, collaboration and knowledge-sharing will be vital in overcoming these obstacles, ultimately bringing electricity to those who still lack it.

Together, we can leverage the insights from #GOGSFE24 to create impactful solutions that change lives across the globe.