Every new PAYGO customer triggers a chain of tasks. First, agents must collect KYC data. Then, back-office teams verify eligibility. Next, warehouses allocate stock. After that, agents process payment and activate the unit. Finally, the customer enters an after-sales cycle that may span years.

Want the full story? This blog highlights the workflow that powers Lumos’s operations. For deeper insights into their digital transformation journey, results, and lessons learned, read the complete Lumos case study.

The Challenge Lumos Faced

When Lumos managed this process across thousands of customers and hundreds of field agents in Nigeria and Côte d’Ivoire, cracks started to show. Verification delays slowed down sales. Stock mismatches frustrated agents. Service tickets fell through the gaps. As a result, the team spent more time firefighting than growing.

The Solution

With Upya’s workflow automation, Lumos replaced scattered spreadsheets and manual handoffs with a five-step digital process. Now, field agents, warehouses, finance, and customer care all work from one connected platform.

Step 1: Customer KYC and Sales Funnel

The journey starts in the field. Lumos sales agents use the Upya Field App to register new prospects with structured KYC data: contact details, GPS location, ID photos, and household information.

As agents capture each application, the system automatically moves the customer through predefined funnel stages, from lead to demo to approval. Consequently, supervisors gain real-time visibility on pipeline performance by agent, region, and stage.

Why it matters: Managers no longer chase agents for updates or consolidate data from multiple sources. Instead, every lead stays tracked from first contact.

Step 2: Data Verification and Approval

Once agents submit an application, a dedicated verification team reviews it on Upya’s web platform. Specifically, they check eligibility, flag incomplete data, and request corrections from agents directly through the system.

After completing their review, the team either approves or rejects each customer. Meanwhile, at every stage, customers receive automated SMS updates so staff don’t need to follow up manually.

Why it matters: Verification bottlenecks slow down sales. However, structured workflows keep applications moving and hold agents accountable.

Step 3: Warehouse Coordination and Stock Allocation

When the verification team approves a customer, Upya instantly notifies the nearest Lumos warehouse and the responsible sales agent. In response, warehouse staff confirm availability, reserve the unit, and either prepare it for pickup or arrange shipment.

Because stock levels update in real time, agents never waste time travelling to locations without inventory.

Why it matters: Stock mismatches and wasted trips erode margins and frustrate agents. Therefore, automated allocation keeps inventory and field teams in sync.

Step 4: Digital Contract, Payment, and Deployment

When the unit is ready, the agent meets the customer to complete a digital contract on the Field App and collect the first payment via mobile money.

Once the system confirms payment, Upya automatically updates the customer’s contract and triggers instructions for product installation and activation. As a result, the process requires no manual handoffs and no waiting for back-office confirmation.

Why it matters: The faster the path from payment to activation, the better the customer experience and the lower the risk of drop-off.

Step 5: After-Sales and Warranty Management

After onboarding, customers enter a structured after-sales environment. Whenever a customer reaches out—whether via call centre or field agent, the system creates a ticket with a scenario-based workflow.

Managing the Full Service Cycle

The system handles visit scheduling, warranty checks, waiver approvals, and stock movements for replacements. Additionally, it tracks every product and its parts, giving Lumos full visibility on costs, inventory, response times, and resolution rates.

Why it matters: After-sales is where customer relationships are won or lost. Structured ticketing ensures nothing falls through the cracks.

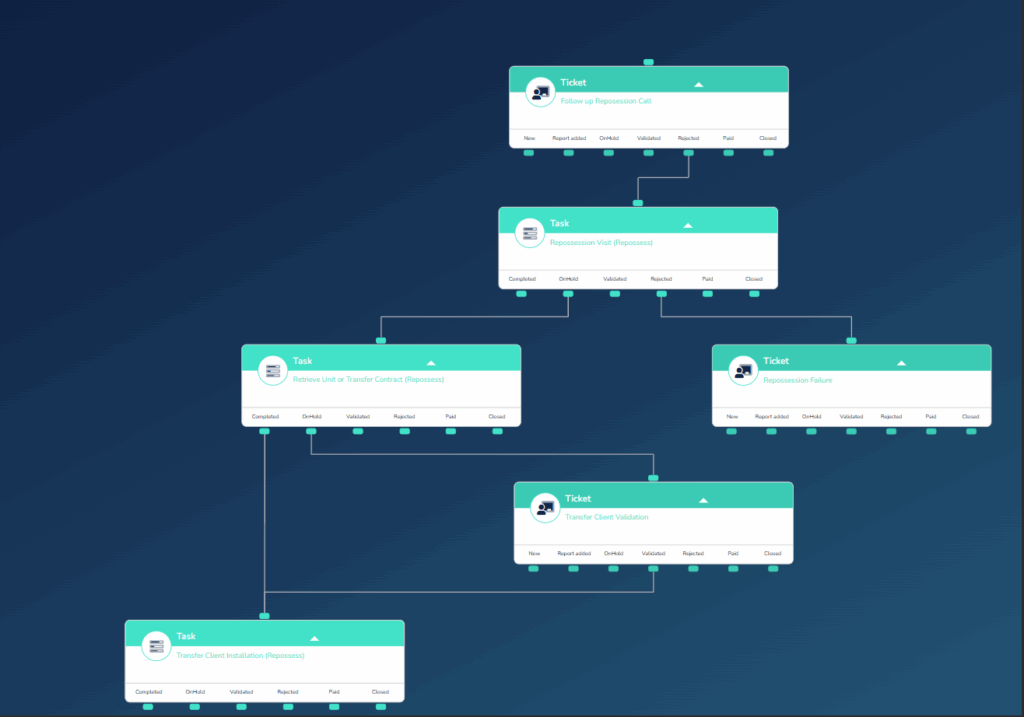

A simple repossession flow.

How Upya Powers the Workflow

This five-step process runs on Upya’s no-code workflow engine, combining:

- Tasks and tickets: assign, track, and escalate work across teams

- Custom forms: capture the exact data each step requires

- Geo-fencing: verify field activity and optimise routing

- Automated rules: trigger actions based on status changes, payments, or time elapsed

- Connected modules: inventory, pricing, payments, and user management in one system

- Open APIs: integrate with existing tools and data sources

The result: every action from onboarding to after-sales is reflected in one coherent operational ecosystem.

Impact on Lumos's Operations

By digitizing and automating the full customer journey, Lumos has achieved:

- Faster onboarding: reduced time from lead capture to activation by eliminating manual handoffs

- Improved data quality: structured forms and verification workflows catch errors before they compound

- Stronger repayment rates: automated payment reminders and clear customer communication

- Tighter inventory control: real-time stock visibility across warehouses and agents

- Scalable after-sales: ticket-based workflows that grow with the customer base without adding headcount

Our partnership with Upya allowed us to move to a dynamic, scalable platform that supports our long term growth. The impact on productivity, service delivery, internal and field coordination has been game-changing.

Alistair Gordon

CEO Lumos Global Tweet

📊 See the numbers: Read the full Lumos case study for detailed metrics on efficiency gains, customer acquisition improvements, and operational outcomes.

Conclusion

From the first KYC form to the last warranty claim, Lumos’s five-step workflow with Upya has turned operational complexity into a scalable, repeatable process. Field teams, warehouses, and back-office staff work from one connected platform with full visibility at every stage.

Ready to see how a similar workflow could support your operations?

Book a demo with Upya and see how a similar onboarding-to-after-sales workflow could support your operations.