Distributors offering products via BNPL (Buy Now Pay Later) or PAYGO (Pay-As-You-Go) models are, in effect, extending credit — similar to commercial banks. However, many distributors lack the tools or systems to manage this credit risk effectively.

Early in the PAYGO boom, the emphasis was on scaling revenue. Unfortunately, they often overlooked the cost of default. By 2021, PAYGO companies collected just 62% of expected monthly payments. Without robust credit risk systems, distributors experienced customer churn, staff burnout, and unsustainable portfolios.

As a result, the sector matures, investors are demanding more. Distributors must now actively manage credit risk and protect customers from over-indebtedness — this is the essence of PAYGO 2.0. Fortunately, Upya provides the tools to make this shift seamless and effective.

What is Credit Risk Scoring in PAYGO?

Credit risk scoring helps determine the likelihood that a customer will stop repaying. To do this, distributors develop a credit scoring model based on client data collected at the point of sale.

Using Upya’s data collection module, field agents embed credit questions directly into client onboarding workflows. Questions may include:

- Employment and income sources

- Household structure

- Existing debts

- Observable indicators like housing materials or appliance ownership

Each response carries a weight based on its predictive value. This approach generates a detailed risk profile for every customer.

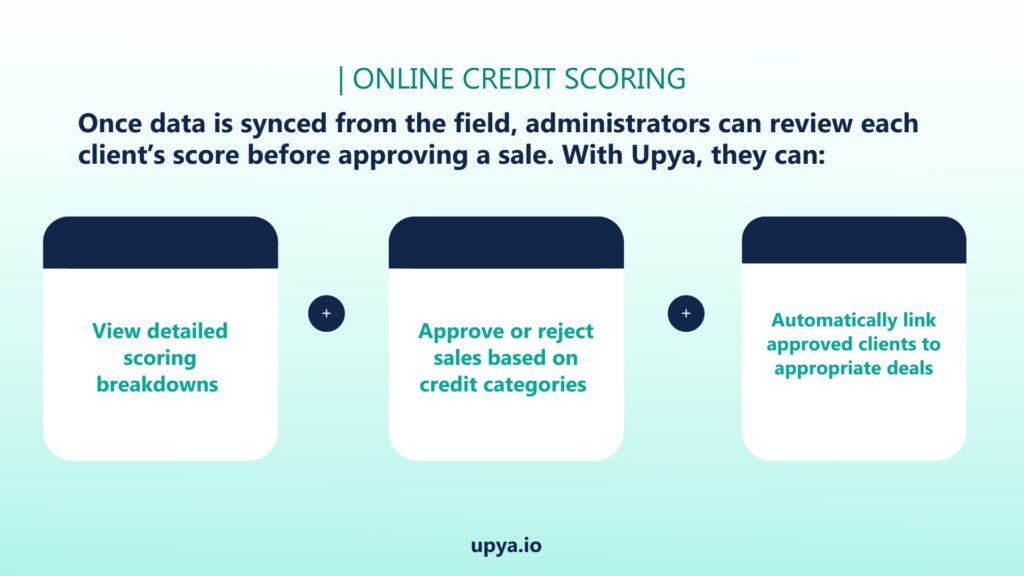

Online Credit Scoring

In doing so, this ensures that each customer is offered a payment plan that suits their risk profile.

Offline Credit Scoring for Remote Areas

For field agents working offline, Upya’s mobile app calculates the credit score in real time. Then the app automatically categorizes the client and restricts access to deals based on their profile. Even in the absence of internet, credit control is maintained.

Why Credit Risk Scoring Matters in PAYGO 2.0

Developing a reliable credit model takes effort — nonethless, the rewards are significant. It improves:

- Portfolio quality

- Customer satisfaction

- Repayment rates

- Operational sustainability

Upya helps distributors embed credit scoring directly into their sales process, whether online or offline. This is critical for businesses transitioning from PAYGO 1.0 to PAYGO 2.0, where sustainability and customer protection are core.

Conclusion: Ready to Digitize Credit Risk Management?

Upya’s credit risk tools give distributors the flexibility to create, test, and scale smarter repayment systems — all while protecting their bottom line.

Want to learn more?

🔗 Book a demo to see how Upya can help your team improve credit control and scale responsibly.

📖 Recommended Read: Helping Off-grid Companies Enhance Credit-risk Management Practices: From PAYGO 1.0 to PAYGO 2.0 by USAID & Power Africa.