In the race to boost agricultural productivity in emerging markets, the ability to afford essential inputs is often the difference between a good season and a missed opportunity. For millions of smallholder farmers, flexible financing isn’t just helpful — it’s essential.

Table of Contents

Why Flexible Financing is Crucial

Barriers Created by Upfront Payments

Upfront payments are a major barrier for agri input distributors and the farmers they serve, especially in emerging markets like Sub-Saharan Africa. High initial costs limit both the reach of distributors and the ability of smallholder farmers to access seeds, fertilizers, or equipment — ultimately stifling productivity and business growth.

According to Farrelly Mitchell, smallholder farmers often lack the capital to make large, upfront investments. This is compounded by limited access to formal credit, high transaction costs, and the absence of collateral.

Distributors also face:

- Slow sales cycles due to affordability constraints

- Limited market penetration because many farmers simply can’t afford inputs at the start of the season

The Impact of Flexible Financing

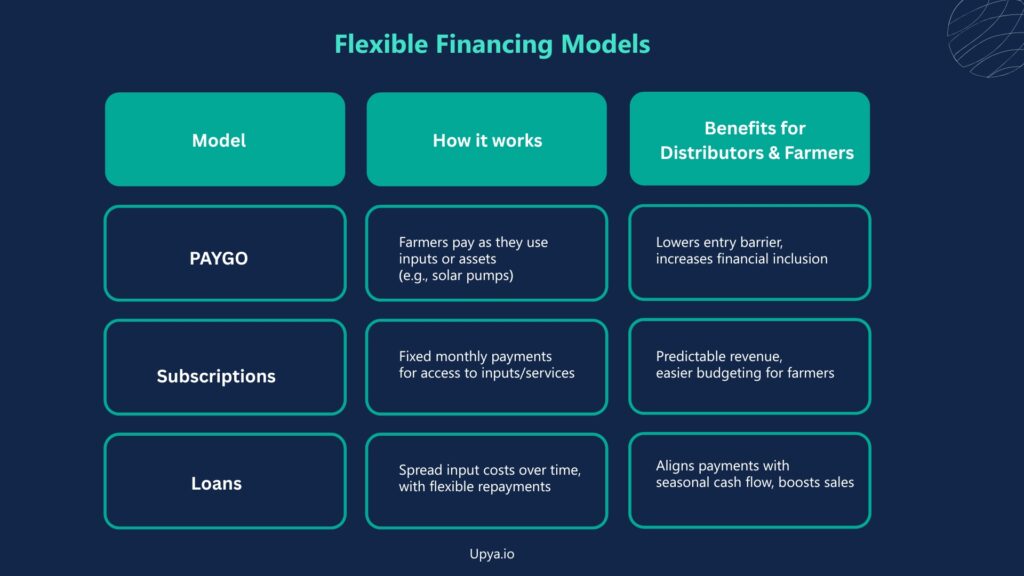

Flexible Financing Models

PAYGO (Pay-As-You-Go)

Farmers pay incrementally as they use inputs or equipment (e.g., solar irrigation pumps).

✔ Lowers the entry barrier and increases financial inclusion

✔ Especially effective for asset-based products

Subscriptions

Farmers make fixed monthly or seasonal payments for ongoing access to inputs or services.

✔ Provides predictable revenue for distributors

✔ Makes budgeting easier for farmers, as noted by Growers Edge.

Loans

Flexible loans spread the cost of inputs over time, with tailored repayment schedules.

✔ Aligns payments with seasonal income

✔ Boosts both input sales and repayment success

Evidence of Payment

In Kenya, access to formal credit among smallholder farmers rose from 5% in 2010 to over 15% in 2020 — largely driven by the introduction of flexible loan products.

By 2022:

- Over 60% of agricultural loans included grace periods and flexible repayment terms

- Enterprises using these products reported higher repayment rates, better cash flow, and improved financial stability

Digital and embedded finance models, enabled by mobile money and digital procurement tools, are further expanding access and efficiency.

Upya: Your Partner in Payment Flexibility

Upya’s all-in-one distribution management platform makes flexible financing simple and scalable for agri input distributors. Whether you’re managing PAYGO, subscriptions, or loans, Upya helps you do it smarter:

- 📊 Payment Tracking & Repayment Schedules: Automate reminders and monitor every payment to reduce missed payments and admin burden

- 🧾 Custom Pricing & Payment Schemes: Configure PAYGO, subscription, or loan-based plans tailored to each customer — all in one place

- 📦 Agents & Shop Management: Digitally manage field teams, inventory, and partners to streamline operations from warehouse to farm

- 📈 Portfolio Health Analytics: Access real-time insights into repayment rates, customer performance, and risk — empowering smarter decisions

Ready to Scale with Smarter Payments?

Book a demo and see how Upya helps you grow your agri input business, reach more farmers, and reduce repayment risk — all while driving impact where it matters most.