In emerging markets across Africa and Latin America, millions are gaining access to smartphones, laptops, and other essential devices through loan financing models like Buy-Now-Pay-Later. As demand for flexible payment solutions rises, organizations need powerful tools to manage the entire customer lifecycle—from onboarding to repayment.

“

The future of finance is digital.”

Ginni Rometty, Former CEO of IBM.

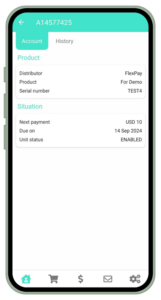

Upya offers a comprehensive Loan Management System (LMS) (see how it works) that helps companies digitize and scale their device financing operations. Complementing this system is Wingu—Upya’s End-Customer App, purpose-built to support organizations offering pay-as-you-go and BNPL services.

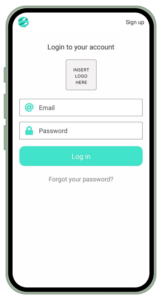

With Wingu, customers can easily onboard, browse available devices, make payments, raise support tickets, and receive real-time notifications—all from a single mobile app. This not only improves customer experience but also increases repayment rates and operational efficiency.

Key Features of the Wingu App

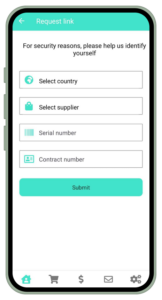

An end-user wanting to apply for an organization’s services can download the Wingu app from the Google Store, fill in a customized KYC questionnaire, and then receive the necessary approvals. Importantly, the process seamlessly connects the Wingu app to Upya’s CRM, allowing for KYC review, approval steps, credit checks, and more.

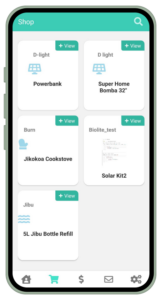

Companies define their offering using Upya’s Pricing Engine (Pricing Engine), which is then automatically reflected on Wingu, complete with product images and short descriptions. As users browse, they can check pricing and payment terms before deciding to purchase a device.

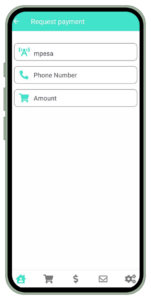

Whether it’s an initial deposit or recurring installment, users can securely complete payments through mobile money—fully integrated across key African markets. This reduces friction and encourages on-time repayments.

End-users can make payments directly from the Wingu app whether for the initial down payment or for recurring repayments. What’s more, the payment feature works in most African countries, as Upya is integrated with multiple Mobile Money gateways.

Automated notifications can be sent through the app for upcoming payment reminders. For example, 2 or 3 days before a payment is due. Additionally, other customized messages can inform users about bonus days or late payment penalties.

Users can raise support tickets directly from the app. Once submitted, all tickets sent to the company´s ticketing dashboard where admins can respond and resolve them. Check out our ticketing system here.

The Wingu app can also be fully white-labeled, featuring your company’s name, logo, colors and made directly available on Google Play Store. As such, your business maintains brand consistency while delivering a world-class customer experience.

📲 Why Wingu is the Ideal App for Device Financing Providers

Upya combines a powerful LMS, locking technology, a field agent app, a ticketing system, and Wingu—our end-customer app to provide a complete suite of tools for organizations offering device loan financing models. Whether you’re launching, optimizing, or scaling your BNPL or PAYGO model, Upya is your trusted technology partner.

Ready to elevate your customer experience?

Discover how Upya’s End-Customer App can help you drive growth and improve collections across your loan financing models, including BNPL and PAYGO.