“Almost 3 billion people lack access to clean stoves and fuels for cooking, instead depending on polluting fuels such as biomass, kerosene, and charcoal for cooking, contributing to significant carbon emissions and leading to the deaths of around 4 million people annually from indoor air pollution,” says the article of Sustainable Energy for All.

Nearly a third of these people are located in Sub-Saharan Africa alone. For many of them, the cost of a more efficient or improved (cleaner) cookstove is out of reach and this is where carbon credits come in.

What are carbon offset projects?

A carbon credit is a tradable certificate that provides its holder with the right to emit one ton of carbon dioxide or an equivalent of another GHG. When purchasing carbon credits, corporations, governments, NGOs, and even individuals finance projects whose aim is to offset the emission of carbon dioxide. These projects must either capture GHG for use, storage or destruction or reduce the volume of GHG emitted (for instance by adopting renewable sources of energy instead of fossil fuels).

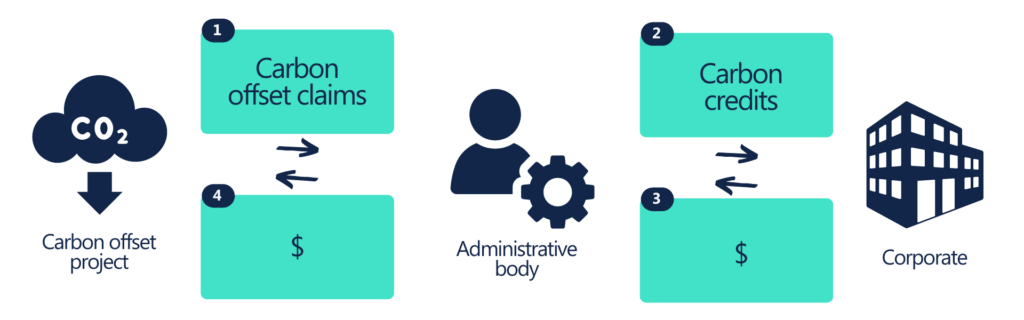

In our example, the carbon credit buyers finance the distribution — for free or at a heavily subsidised price — of clean cookstoves with no (or very little) emission of CO2. For the carbon credits to be issued, a project has to be part of an offset program that will set some ground rules as to its design and implementation. Independent administrative bodies (such as the UN Clean Development Mechanism, Verra or Gold Standard) are in charge of the validation and certification of the offset claims. The certification acts as a guarantee that the impact reported is real and adequately measured. The impact of this project on emissions and the carbon credit ownership are kept in a registry to reduce the risk of double counting.

Carbon offset claims are audited and certified by an administrative body that issues carbon credits, purchased by corporate to offset their emissions. $ spent on carbon credits by the corporate finances the carbon offset project.

Compulsory VS. voluntary carbon credit market

Companies are required by law to purchase carbon credits if their activity is producing more emissions than the law permits — this is the compulsory carbon credit market and it was created as a way to mitigate the impact of GHG emission on climate. This market is regulated by mandatory national, regional, or international carbon reduction regimes. In 2005, after the ratification of the Kyoto protocol, carbon credits financed an emission reduction project for the first time.

As the need to address climate change accelerated dramatically, the voluntary carbon credit market came to life — it allows carbon credit buyers to compensate for the emissions they produce through their daily activities and is now seen as a critical way to achieve net-zero emissions. For corporations and local authorities active on the CSR front or mindful citizens, purchasing carbon credits enables them to fight climate change and positively impact the communities where the projects take place.

A growing market

According to the taskforce on Scaling Voluntary Carbon Markets (TSVCM) initiated in 2020 by Mark Carney as UN Special Envoy for Climate Action, demand for carbon credits could increase by up to 100 times by 2050 — possibly reaching more than USD50 billion. By early May 2021, the cumulative volume of carbon credit traded on the NY-based exchange Xpansiv CBL for the year had already reached 30 million tons (compared to 31 million tons for the full year 2020).

Where Upya adds value

The organisations leading these projects — our clients — need software that will facilitate and rapidly scale deployment of the units on the ground while enabling extensive client data collection through time to successfully pass the onerous verification processes and obtain certification from the carbon credit organisations.

With Upya, data collection is versatile and incredibly efficient, including conditional questions and prepopulated answers. The Upya mobile app operates on and offline and can capture unlimited high quality-low data pictures on a daily basis, collects signatures, GPS coordinates and signing dates. This allows tailored data collection to in the most remote places away from reliable network connections.

Before certification is obtained, a sample of the client base is likely to be audited to confirm that the records provided are representative. Upya’s inventory and customer management features enable the auditors to easily identify and locate the beneficiaries and their units. The software facilitates our client’s own internal validation checks prior to the start of the certification process ensuring that nothing is left to chance.

Finally, our tailor-made analytics enable to manage and strategise deployment following the latest KPIs.

Carbon Credits

Upya enables players in the carbon credits space to run their carbon offsetting project at scale